The Association of Real Estate Funds is a not-for-profit trade association, based in the City of London.

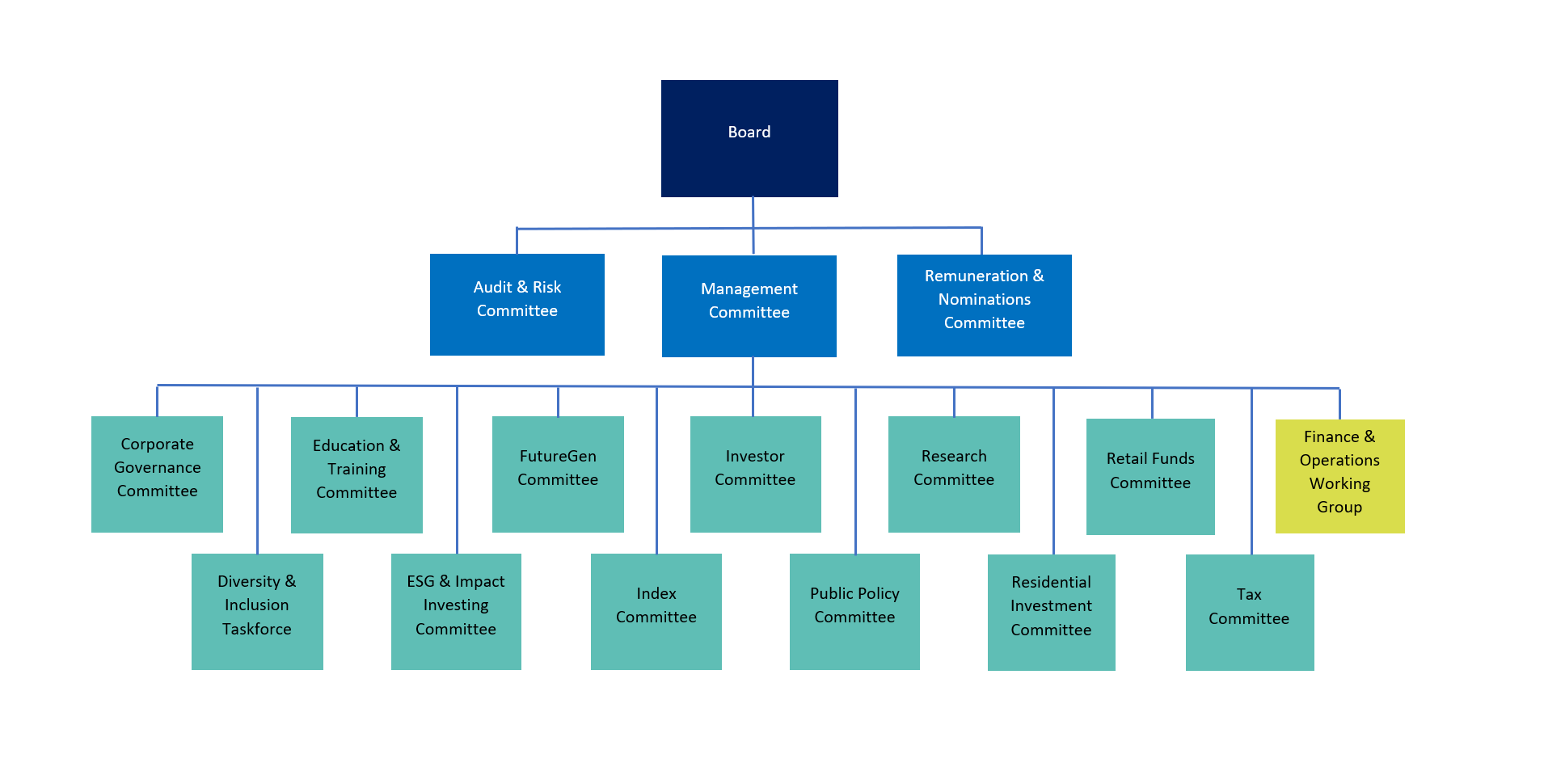

Much of the association’s activity is driven by the valuable work of our various committees within AREF. Each one reports into our Management Committee, responsible for steering the association, which in turn reports into the Board, the overall governing body for AREF.

As such, we benefit from the collective expertise and extensive experience of representatives from all our member firms, as well as professional investors and investment consultants.

Structure

The AREF Board

The Board is responsible for the strategic direction of the association. It consists of eight non-executives, one of which is the Chairman, and one executive director, the Chief Executive Officer for AREF.

Anne Breen, Chair

Global Head of Real Estate, Aberdeen Investments

Anne began her real estate career at Aberdeen Investments in 1999. She was appointed Head of Real Estate Research & Strategy in 2007 and over her tenure has seen their real estate assets under management quadruple to more than £40bn.

Anne has been instrumental in the modernisation of the Aberdeen Investments real estate business over the last 26yrs, embedding and driving a research driven approach which underpins the overall performance of their underlying funds, the launch of a number of innovative products including global real estate strategies and UK long income franchise, and the management and development of world class real estate investment teams.

Anne’s experience across all real estate asset classes, including debt and indirects, and deep understanding of the role of ESG in real estate investing, is essential in her role as Global Head of Real Estate where clients are increasingly aware of the broader benefits of real estate as an asset class.

Anne is chair of AREF's Board. She also sits on Aberdeen Investment's Global Inclusion Committee, is a board member of Aberdeen Investment's Alternative Funds Board (regulated by FCA) and a board member of Aberdeen Investments Ireland Limited (regulated by CBI).

Kevin Aitchison

Managing Director- Equity Investments UK & Europe, Savills Investment Management

Kevin is Head of Equity Real Estate – UK and Continental Europe at Savills IM.

As head of the European business (excluding debt), Kevin is responsible for the day to day operations and ultimately for the delivery of Client target investment returns within appropriate risk adjusted parameters. He was formerly CEO of Knight Frank Investment Management and CEO at ING Real Estate prior to that.

Kevin is a member of the Investment Property Forum and in 2021 was awarded an MBE for his many years of service to GB Wheelchair Rugby and disabled people.

Paolo Alonzi

Head of Structuring & Operational Strategy , Aberdeen

Paolo is a qualified Chartered Accountant and recently returned to Aberdeen as Head of Structuring and Operational Strategy – Alternatives, having previously held the position of Real Estate COO. As a member of the Real Estate leadership team and with a broader role across Alternatives, Paolo is and was responsible for providing strategic leadership and input at both business and product level and as Real Estate COO he was also responsible for overseeing and managing the profitability of the real estate division. Paolo has been heavily involved in and often lead on a number of high-profile initiatives including a wide range of product launches, the industry leading merger of two PAIFs, and the development of the firm’s commercial real estate lending platform, as well as playing a key role in developing the firm’s leading real estate ESG capability. Paolo has been a member of the AREF Board since 2018 and an active voice for the industry on open ended real estate funds and the development of the LTAF.

Edmund Craston

Independent Consultant

Edmund is an experienced real estate business leader with deep knowledge of management and of real estate and equity and debt capital markets, both public and private.

He was the Managing Director (and Partner) of Rockspring Property Investment Managers from 2009-2018, responsible for strategic direction and day to day operations, and was Senior Managing Director, Head of Fund Management and a member of the Senior Leadership team and Operational Board of PATRIZIA from 2018-2021. He has extensive experience of chairing and participating in Investment Committees and other key corporate and fund governance boards and committees, including ESG committees.

Before joining the real estate investment management industry he had a long career in investment banking, and he was European Head of Real Estate Investment Banking at both UBS Investment Bank and Lehman Brothers. There, and as an independent consultant following the Global Financial Crisis, he advised a wide range of companies and investors on capital raising, corporate finance strategy and M&A transactions from 1987-2009.

Alistair Dryer

Partner - Business Development & Strategy, Knight Frank Investment Management

Until December 2024, Alistair was a head of Europe at LaSalle Global Solutions. He moved over from Aviva Investors in 2018, where he was Head of UK Capital GIRE and a Senior Fund Manager, responsible for a number of key client accounts. Alistair joined Aviva Investors in March 2009, previously having worked at ING Real Estate for nine years, firstly in the research team and then in the Multi-Manager team.

Alistair holds an LLB in Law and an MSc in Management and IT from the University of Leicester. In 2009 he completed the IPF Diploma. Alistair is also a member of the INREV Secondary Markets and Liquidity Committee.

Andrew Grigson

Managing Director, Business Development, PGIM

Andrew Grigson is a managing director at PGIM Real Estate. Based in London, Andrew is responsible for business development, capital raising and marketing PGIM Real Estate’s global real estate products and services to UK and Dutch institutional investors.

Prior to joining PGIM Real Estate in 2009, Andrew was a director of the UBS Global Asset Management UK Real Estate business, originally joining the team in 2004 as an asset manager but latterly handling investor relations for the UBS Triton Property Fund.

Earlier, Andrew spent 10 years with Jones Lang LaSalle / LaSalle Investment Management, working mostly on UK discretionary separate account mandates.

Andrew is a member nominated Trustee of the PGIM UK Retirement Savings Scheme and is also a Trustee of a London-based charity.

Andrew has over 26 years of real estate industry experience and is a member of the Royal Institution of Chartered Surveyors.

William Hill

Non Executive Director

William holds a number of positions, including, Chairman at Ediston Property Investment Company plc Board Member at Old Oak and Park Royal DC (OPDC) NED Mayfair Capital.

Prior to becoming a consultant in 2014, William joined Schroders in 1989 as a fund manager, Promoted in 1990 and then to head of property in 1991.

He has a BSc in Land Management from Reading University.

Rebecca Middleon

Fund Manager, DTZ Investors

Rebecca’s core competencies are in the management of indirect property portfolios and she has a range of experience including:

- Developing investment strategies for investors;

- Implementation of investment strategy through sourcing, negotiating and underwriting new issuance and secondary market transactions;

- Appraisal of investment managers;

- Fund due diligence;

- REITs and more liquid structures

- Trading, redemptions and fund liquidations.

Rebecca is a holder of the Investment Management Certificate (IMC January 2010)

Degrees

Rebecca has a BSc (Hons) Economics, University of Surrey (2009)

Tom Pinnell

Commercial Director, Langham Hall

Tom joined the Real Estate division of Langham Hall in July 2019. He works primarily with UK Real Estate managers in the setup and ongoing administration of various investment structures.

Prior to this, Tom worked at global fund administration firm Vistra.

Tom has a Bachelor’s degree in Biology from Cardiff University, graduating in 2013, and is currently studying towards becoming a CAIA charterholder.

Paul Richards

CEO, AREF

Paul is the CEO of AREF. Before joining AREF in 2020, Paul was Head of the European Real Estate Boutique within Mercer’s investment consulting business for almost 10 years, previously he was Head of Indirect Real Estate Investment and Global Managed Accounts at LaSalle Investment Management, where he was responsible for managing global portfolios of unlisted real estate funds for clients from Europe and Asia Pacific.

He has over 25 years of real estate experience in investment, corporate finance and research, and has advised investors, occupiers and venture capital companies on property portfolio strategy and on financial structuring, including PFI, senior and mezzanine debt and joint venture arrangements. His employers have included LaSalle Investment Management, Cushman & Wakefield and Henderson Investors.

Before coming into the world of real estate, Paul worked in marketing and market research. He originally studied Physiological Sciences at Lincoln College, Oxford and has a Master of Science in Real Estate from City University Business School, London, now Cass Business School.

Lisa Sherriffs

Chief Compliance Officer, PIMCO Prime Real Estate

Senior Lawyer with over 20 years’ international experience in asset management and financial markets at top tier private practice (Norton Rose Fulbright LLP) and in house for leading investment managers (most recently with Columbia Threadneedle Investments) as well as with AREF, the Real Estate Funds’ industry standards body, promoting best practice in corporate governance and transparency. Possesses detailed knowledge of all aspects of the law as it applies to RE funds, international regulation, debt and equity transactions with particular expertise in board advisory and shaping strategic solutions