GRESB (formerly know as the Global Real Estate Sustainability Benchmark) assesses and benchmarks the Environmental, Social and Governance (ESG) performance of real assets, providing standardised and validated data to the capital markets.

GRESB Real Estate Industry Partner

AREF were delighted to become a GRESB Real Estate Industry Partner in January 2020. ESG and social impact investing are very important to our industry and we believe committing to this partnership will help raise the profile of sustainability issues with our members.

Extension of GRESB Real Estate and Infrastructure Assessment submission deadlines

In light of the challenges facing GRESB Members and following guidance from their governance bodies, they have decided to extend both the GRESB Real Estate and Infrastructure Assessment submission deadlines by 1 month to August 1, 2020. Read the full announcement here.

10 years of GRESB

GRESB has recently been celebrating their 10 year anniversary. You can find here what they have achieved in the last 10 years and their plans going forward.

GRESB Real Estate Assessments

GRESB Real Estate Assessment 2019

Participation in the GRESB Real Estate Assessment in 2019 included 1,005 property companies and funds with an aggregate value of USD 4.1 trillion. The data represents 100,000 assets of which 66% are reported at asset level. In 2018, the performance of funds reporting to GRESB continued to increase with the average score increasing by 5 percentage points to 72. The listed sector continues to maintain an advantage over the private sector, however the gap between the two is now only negligible.

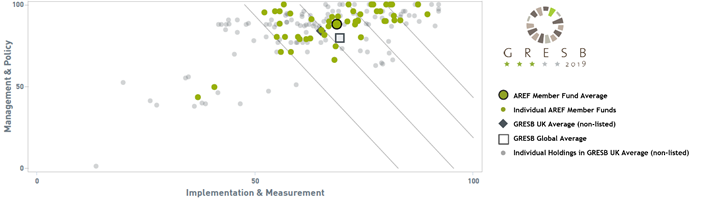

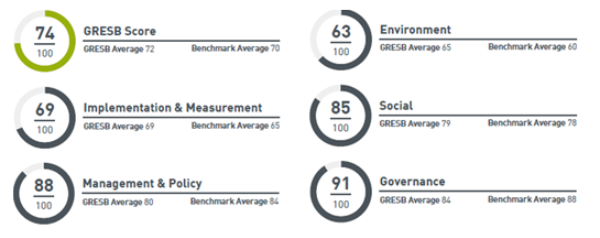

Below is the GRESB performance of AREF members in 2019.

AREF Member Funds - 2019 GRESB Performance

Note: The results below are equal weighted.

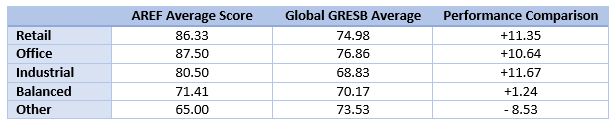

Below is a breakdown of the AREF member fund GRESB scores compared to the Global GRESB average by sector. AREF member funds are outperforming the GRESB global average in every sector category with the exception of Other.

Key Highlights

- The response rate for AREF Member Funds in 2019 was 83%, 96% of which were awarded Green Stars.

- The AREF Member Fund Average outperformed both the UK and Global GRESB benchmarks with a score of 74.

- In both the Management & Policy and Implementation & Measurement dimensions, the AREF Member Fund Average scored 4% higher than the UK benchmark.

- AREF Member Funds performed particularly well in Social related questions outperforming the UK average by 7%.

- AREF member funds are outperforming the GRESB global average in every sector category with the exception of Other.

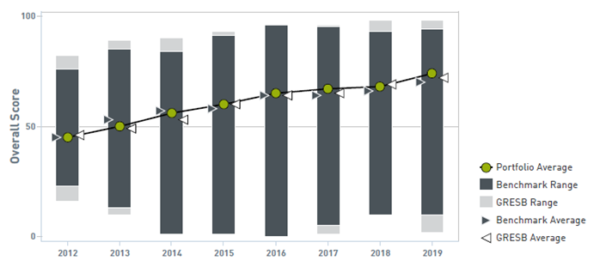

AREF Member Funds – Historical Trend

GRESB Real Estate Assessment 2020

Participation in the 2020 Assessment grew by 22% to cover 1,229 portfolios (2019: 1,005) worth more than USD $4.8 trillion AUM.

This increase in participation, coming despite the challenges of the covid-19 crisis, shows an industry responding decisively to the accelerating investor demand for comparable ESG data.

The private sector led the growth trend, with participation growing 32% to cover 953 non-listed portfolios (2019: 723). On the listed side, 271 REITs and property companies reported to GRESB (2019: 240), an increase of 13% on the previous year.

Below is the GRESB performance of AREF members in 2020.

AREF Member Funds - 2020 GRESB Performance

Note: The results below are equal weighted.

For more information on GRESB, please visit their website here.