Download Guidance on Expense Ratios

Following a consultation with all of AREF's members in early 2022, AREF has brought its Guidance on Expense Ratios in line with the Total Global Expense Ratio (TGER ) agreed by INREV, ANREV, NCREIF and PREA

The new guidance should be followed for expense ratio reporting by AREF Fund Members from 1st April 2022.This replaces AREF’s previous Guidance on the Total Expense Ratio (TER) which can be found here. AREF Fund Members are expected to follow the TGER requirements. In addition, they should report the expense ratios as a proportion of both NAV and GAV. Also, where performance fees are applied, the expense ratio should be reported with and without the performance fees.

More information on the proposed reporting requirements can be found in the guidance and within the Q&A below. We always welcome additional questions from members which we will endeavour to answer and add to the Q&A.

AREF held a webinar for members on the 8th June 2022. To view all materials from this event, including the recording, click here.

Q&A

1. What are the significant differences between AREF’s guidance on the Total Expense Ratio (TER), TGER and the new AREF guidance?

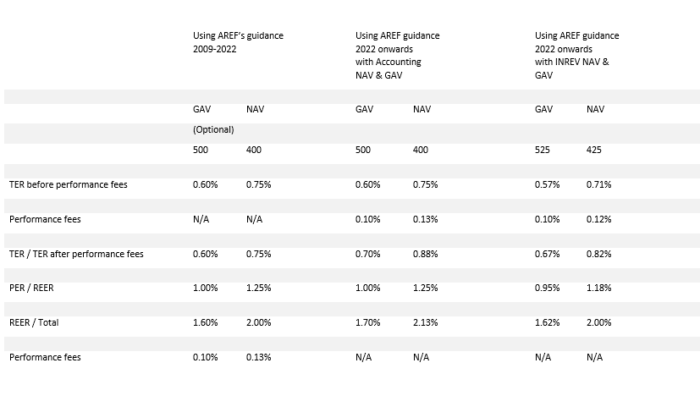

One of the main changes is alignment of terminology in AREF's guidance with the new TGER. Historically there was a difference, resulting in some confusion, as AREF used the term “Property Expense Ratio (PER)” to mean property level costs for which INREV used the term “Real Estate Expense Ratio (REER)”. AREF used “Real Estate Expense Ratio (REER)” to mean the total of TER and PER. The new terminology is aligned with that of INREV.

There is no specific term for the total (which was AREF REER) and we have proposed to simply use “Total” on the disclosure table.

Other changes are:

- The inclusion of performance fees in TGER. To aid understanding and comparison, we have stipulated that AREF member funds should disclose TGER before and after performance fees.

- AREF TGER should be reported as a percentage of GAV and NAV. Previously only NAV was mandatory.

- There may be differences in the calculation of NAV (see Q2 below)

- Abortive deal fees are now included in TGER rather than PER/REER.

Please see page 2 of AREF’s Guidance on Expense Ratios for more detail.

A worked example can be found below.

2. Which NAV and GAV should I use?

NAV and GAV should be the relevant reporting NAV and GAV of the fund. Most funds in the UK use accounting NAV and GAV although a small number use INREV Reporting NAV. Disclosure should make clear what NAV and GAV is being used.

3. Are there any circumstances where there would be subscription or redemption fees paid from the fund to the manager?

AREF are not aware of any circumstances where there would be subscription or redemption fees paid from the fund to the manager.

4. Is TGER calculated differently to the charge cap and CTI reporting?

The TGER, the charge cap for defined contribution pension schemes and the Cost Transparency Initiative (CTI) templates, used particularly by defined benefit pension schemes, all seek to distinguish between fund level and property level costs. AREF, in its application of the TGER, requires separate disclosure of performance fees, which makes it easier to compare the numbers. Whilst the reporting is very similar for direct property funds, differences arise for fund-of-funds and other indirect investments. The TGER is specific to the fund vehicle whereas the charge cap and the CTI reporting seek to capture costs on a look-through basis. You can find AREF’s information on CTI reporting here. The Department of Work and Pensions (DWP) has been consulting on changes to the DC charge cap. You can find AREF’s response to the most recent consultation here.

5. Portfolio Turnover Ratio – Is there any change to this?

The Portfolio Turnover Ratio has been dropped from the guidance and is no longer required. It was originally a requirement for authorised funds but that is no longer the case and following discussion with AREF Investor Members, it was concluded that investors no longer use it. There is therefore no need to report it going forward.

6. Why are ‘abortive deal costs’ now deemed a ‘fund level’ TGER cost rather than property level cost?

This was debated in the Working Group. Although there are valid arguments for ‘abortive deal costs’ not being included in TGER, this would be inconsistent with the treatment adopted by everyone else, and it was considered better to have alignment with the TGER. It was not anticipated that this would have a material impact for most fund managers.

7. To facilitate like for like comparison, wouldn’t a standard accounting NAV (under IFRS / FRS 102) be preferable, i.e. rather than also including INREV NAV’s in the mix?

A small number of UK funds report their NAV using INREV Reporting NAV. INREV Guidelines require TGER to be calculated using INREV Reporting NAV. The Working Group decided that TGER should be calculated using the fund’s normal reporting NAV, whatever that might be.

8. What is the difference between “fees” and “costs” and should they both be included in the TGER?

“Fees” describe charges by the manager for fund management, transaction and oversight services and “Costs” describe third party charges. Both should be included in the TGER.

9. Over what period should transaction and performance fees be measured in the expense ratios?

Transaction and performance fees should be measured over the usual reporting period for the fund, whether this is quarterly, half-yearly or annually. We appreciate that these types of fees can vary throughout the year.

The TGER can be presented over more than one period eg. quarterly and annually.

10. Is forward looking reporting mandatory?

AREF has not made it mandatory for its members to provide forward looking reporting. Although, this type of reporting is often provided to potential investors as part of the due diligence process.

11. Does a daily-traded open-ended fund have to calculate the time-weighted average GAV and NAV on a daily basis for the denominator for TGER. Can we use quarterly GAV and NAV as an approximation?

Example of how the disclosures differ between the previous AREF guidance and the new one - you can also view this here.