AREF members gathered at CBRE’s Henrietta House on 18 November for a lively and well-attended session exploring where capital is flowing across the UK real estate market.

The morning opened with a welcome from Stephen Marshall of CBRE, then led on to a live poll led by moderator Steven Devaney, before four sector specialists presented their investment cases.

Opening poll results

If you had capital to invest today, which sector would you choose?

-

Living: 52%

-

Offices: 15%

-

Retail: 10%

-

Data Centres: 19%

-

Undecided: 5%

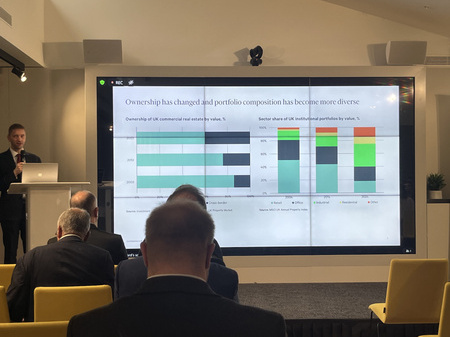

Keynote & Moderation – Steven Devaney, Senior Director, CBRE UK Research

Steven opened the session by framing current capital flows across UK real estate, highlighting how shifts in investor ownership, transaction activity, lending and sentiment have altered the investment landscape. He then introduced the sector pitches and guided the discussion throughout the morning, including overseeing both live polls and the Q&A.

Offices – Tom Newman, Managing Director, Dominium Real Estate

Tom focused on opportunities within the regional office market. Structural change, hybrid working and widening yield spreads have reshaped the landscape, with demand concentrating around high-quality, ESG-compliant space. Limited development and supply constraints are supporting rental growth, particularly in the “Big Six”. Refurbishment-led strategies continue to present value where ESG improvements can be delivered.

Living – Jos Seligman, Investment Director, Swiss Life Asset Managers

Jos set out the long-term investment case for the living sector, driven by persistent demand/supply imbalance and very low levels of institutional ownership (around 3%). Residential has been less volatile than most commercial sectors and has outperformed inflation and “all property” over long periods. Key risks include affordability, ensuring the right amenity offer and achieving operational scale.

Retail – Allan Lockhart, CEO, New River

Allan highlighted improving consumer conditions and resilient in-store spending, supported by rising real wages. Online penetration has levelled off, with omnichannel retailers gaining market share. Vacancy rates have been trending down, rental growth is re-emerging and pricing remains attractive. Liquidity has strengthened, with interest from REITs, institutions and private buyers.

Data Centres – Hannah Kramer, Chief Legal Officer, Apto

Hannah outlined the surge in demand for hyperscale and AI infrastructure. London remains the key EMEA hub, with new regional clusters emerging. Power availability and grid constraints remain the main challenges, alongside high capital expenditure, but long-term demand, global investment trends and supportive policy direction continue to underpin the sector’s strength.

Q&A highlights

The session concluded with a well-supported Q&A moderated by Steven Devaney, reflecting the strong engagement from members throughout the morning. A broad mix of questions was submitted through the live polling tool and from the room, allowing the discussion to range across the themes raised in the presentations.

The conversation touched on:

• how investors are approaching market and sub-market selection in the current cycle

• the operational demands in more service-led sectors such as living and data centres

• ESG-driven refurbishment, energy performance and futureproofing assets

• affordability pressures, tenant expectations and long-term rental resilience

• liquidity, pricing and how different sectors may respond as conditions stabilise

Speakers responded to questions by drawing on practical examples, recent transactions and on-the-ground experience. The Q&A helped to compare the relative strengths, risks and time horizons of each sector, providing useful context ahead of the closing poll.

Closing poll results

Having heard the expert pitches, which sector do you now believe offers the most attractive opportunity for the next 12–18 months?

-

Living: 44%

-

Offices: 21%

-

Retail: 19%

-

Data Centres: 14%

-

Still undecided: 2%

Living remained the strongest performer, though Offices and Retail both gained support after the presentations, and the number of undecided voters fell sharply.

Thank you

Thank you to CBRE for hosting and to all speakers and attendees for contributing to a thoughtful and well-supported session.

Slides

Download the slides by clicking here or the image below {you will need to log-in to view these}:

Photos

If you would like to suggest future themes or take part in an upcoming event, please contact the AREF team by emailing us at [email protected].