Recent tax changes have made Real Estate Investment Trusts (“REITs”) a more attractive vehicle for UK property investment. This trend will only continue due to increased corporation tax from 2023, and widely-expected changes to the UK’s REIT regime.

In order to explain the increasing appeal of REITs, it is worth comparing the position against two other common property investment structures (a Jersey Unit Trust (“JUT”) and an offshore property investment company (“Propco”)), in three different time periods:

- prior to April 2019;

- “present-day”; and

- the expected position, post-April 2023 (when the UK’s main corporation tax rate increases from 19% to 25%)

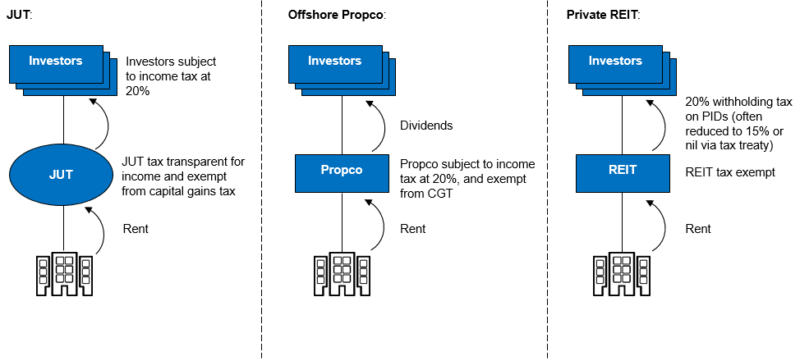

Prior to April 2019

In terms of tax treatment, the property investment landscape was fundamentally different prior to April 2019. As can be seen in Diagram 1, at this time the JUT and Propco were both exempt from capital gains tax. Further, benign interest deduction rules (prior to the introduction of rules restricting corporate interest deductions) resulted in a very low effective tax rate.

Though the ultimate withholding tax on a REIT-investor’s receipt of property investment dividends (“PIDs”) could often be reduced to 15% (or even nil) via double tax treaty provisions, the low effective taxation of other structures and administrative requirements of REITs often made the alternatives more attractive.

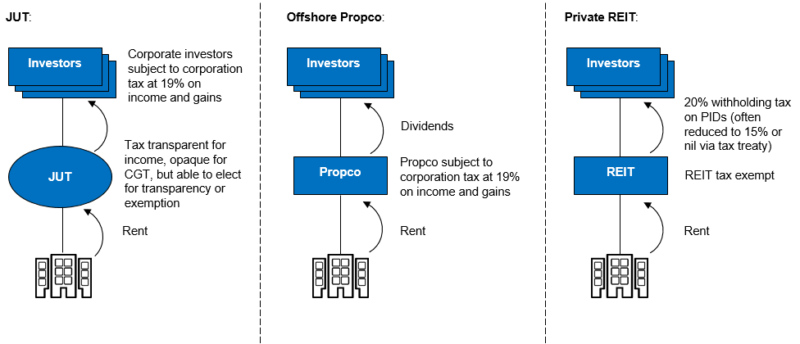

“Present day”

As can be seen in Diagram 2, the:

- addition of non-residents capital gains tax;

- extension of corporation tax to UK property income of non-resident investors; and

- the consequential application of the corporate interest restriction rules;

have increased the tax burden in a JUT or Propco structure – while the tax regime for REITs remains the same.

The comparison between the structures in terms of the cost and administrative burden remains the same as pre-April 2019.

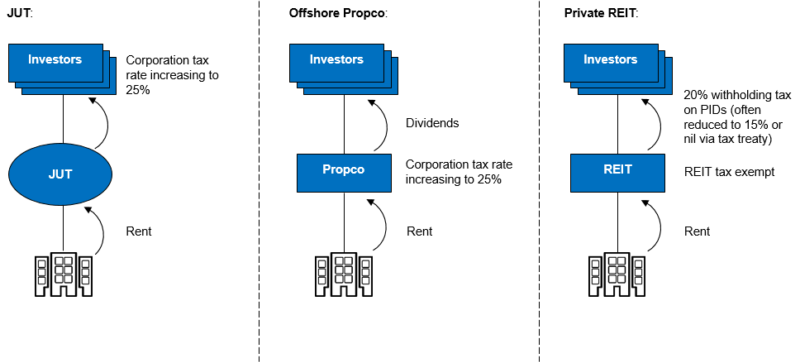

Post April 2023 (expected)

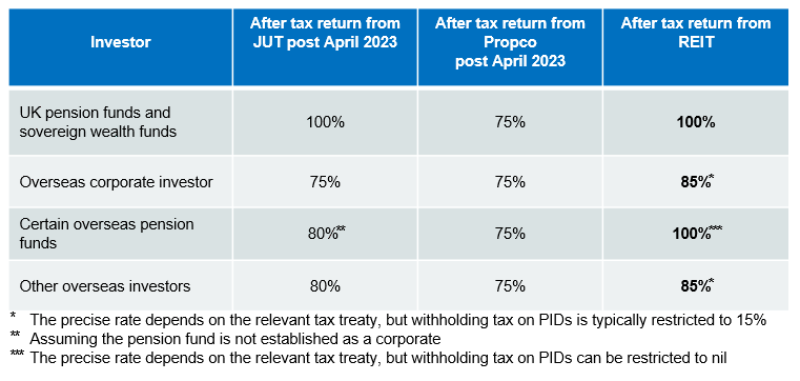

As demonstrated in the table below, the increase of the UK corporation tax rate to 25% is likely to “tip the balance” in favour of a REIT from a tax perspective, for many classes of investor.

In addition, REITs will become increasingly straightforward to set-up and operate. There is a suite of expected reforms to the REIT regime such as:

- relaxation of the requirement for a REIT’s shares to admitted to trading on a recognised stock exchange, for REITs held by institutional investors;

- narrowing the “holder of excessive rights” rules, in order to allow certain UK resident corporate investors to hold 10% or more of a REIT without structuring;

- an easier to apply “balance of business” test; and

- widening the types of institutional investor that will be able to hold the REIT as a private vehicle.

A combination of a relaxed administrative regime and (for certain types of investor) clearly advantageous tax rates are likely to make the REIT the property investment structure of choice for many investors.