View Event Video Here

(this video is for members-only - click here to register/re-set password)

View Slides Here

Event Summary:

AREF’s Education and Training Committee teamed up with the FutureGen Committee to present this very well attended and thought provoking panel discussion on the ‘Wellness Trend’ and how it is influencing the real estate strategies of both occupiers and landlords alike. This event was sponsored by Vistra and kindly hosted by Schroders.

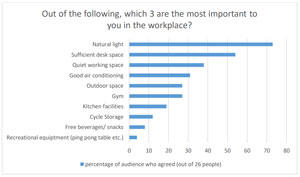

Delegates were welcomed by Tom Pinnell, Chair of the AREF FutureGen Committee and senior business development manager at Vistra. Tom then introduced the moderator for the session, Clare Thomas, Real Estate Partner at CMS and author of the report ‘Smart. Healthy. Agile.’ After briefly introducing the panel, Clare started the proceedings by putting a live poll to the audience using Slido.

The question and results are tabled below.

To set the scene and to give context of her own particular interest in this topic, Clare went on to briefly talk about the CMS report ‘Smart. Healthy. Agile.’ which looked at how technology and changing attitudes to work are transforming the nature of what we expect from our buildings. As Clare put it “investors, developers and occupiers alike are evolving from space providers and users, into creators and curators of experience, wellness and community”.

To write the report, CMS not only sought the views of 350 real estate professionals and 8 industry experts, but also over 1,000 office workers in cities, towns and business parks across the UK, asking them what they actually wanted from their buildings. The live Slido poll was one of those questions asked. Interestingly, the results in the report highlighted that what office workers wanted didn’t always match what the real estate professionals thought they wanted. The full report can be found here.

That said, both groups apparently did agree that buildings do affect our physical and mental health and there is clear evidence that the real estate industry is responding positively, bolstered by a rise in new brands of certifications. Indeed, 79% of real estate professionals saw WELL building certification as being important in making an office building attractive to occupiers.

Charlotte Jacques, head of sustainability and impact investing at Schroders Real Estate then delivered a keynote speech, discussing Schroders’ view from two perspectives, occupier and investor.

As an occupier, with their new HQ, Schroders sought to create a place that would attract staff from the moment they were on the approach to the building, with plenty of attractive green space around the building, connecting to the roman wall and easy access to the Barbican complex. They wanted to focus on ease of use, comfort, flexibility, enjoyment and the delight of its occupants. Their approach is one that goes beyond the physical environment aiming to be more holistic, to provide health and wellbeing in fitness, financial and the work-life balance. It comes from the buy-in at the most senior management levels and HR are very much involved.

As an investor, Schroders also support the notion of national wellbeing; society health and happiness promotes business health and productivity. Charlie explained that Schroders include wellbeing as part of their investment approach. They have surveyed their tenants and assessed all their properties accordingly. Theirs seems to be akin to an impact investment approach.

The panel session followed, with Clare moderating. Joining Charlie on the panel were: Chris Hiatt, Director at Landid, the developer of the Porter Building in Slough – the first WELL rated building in the UK; Michael Brodtman, Executive Director Valuations Advisory at CBRE; Dr Lee Elliott, Partner, Global Head of Occupier Research at Knight Frank and author of (Y)OUR Space, Insights from the Global Workplace, found here. ]

While introducing himself, Chris explained how the Well Building Institute had approached them regarding the Porter Building in Slough they were developing with Brockton Capital. They had agreed on the merits of attaining the Gold Award, partly as a differentiator for an office in Slough, effectively allocating some of the marketing spend for the building to the expense of attaining Gold.

Lee spoke passionately about there being a structural change in the real estate industry to focus on ‘customer need’. He spoke of real estate now being a strategic device, from the corporate tenants’ perspective, in order to support, facilitate and/or portray a change in a company’s culture. In light of the tight labour markets, the physical real estate and the experience it presents is being used to help attract and retain staff.

Michael told delegates he was receiving lots of questions about return on investment regarding WELL. He thinks it too early to detect any meaningful empirical evidence. He also questioned how much spend would be down to the landlord versus the tenant. During the ensuing discussions, many interesting points arose. Please see the full video for the details but the following is a summary of the highlights.

The WELL rating only lasts three years, so has to be revisited throughout the building’s life. Chris made the point that the landlord can only provide the hardware, the occupier has to embrace wellness too, at which point they work together going forwards. They are currently looking at another site, with the intention to develop it to the Platinum standard this time. They are also considering building office space ‘closer to home’, so people can avoid the stresses of the daily commute.

Lee emphasised that this was a structural trend being led by the customer. As such, providing the requisite service would be an obligation – though there may be an opportunity for landlords to monetise some services. His report suggests occupiers are now more focussed on retaining staff than beating rents down – property being only 15% of their total costs. He was also keen to highlight that this trend was not just about millennials. This was very much about the desire of companies to retain talent of all ages, especially in an era of the working life extending.

Michael pointed to the past trend in sustainability and how that affected the market. In this way, he suggested wellness is likely to become part of the definition of ‘prime’. He was less certain on any premium achievable on valuations for the landlord though. He has yet to see any lenders vary terms on the back of wellness but he is aware that lenders are looking at such measures. He reminded delegates that London offices were 95% full and that maybe any differences in valuation metrics would show themselves more in a property downturn, where tenants have more choice of space. It was suggested that perhaps while a building geared up for wellness may not achieve an immediate return reflected in its valuation, it may lessen the rate of its obsolescence.

In response to another question from the floor, the panel made it clear this was a trend that was pervading across sectors, not limited to offices. Indeed, probably second only to offices, residential is a sector where the most change can be seen.

Emphasising the importance of the wellness trend, Clare informed delegates that it is estimated that mental health costs the UK economy over £100bn each year. It is the change in corporate ethos that is more important than the changes in technology involved around this trend. This is why HR are becoming very involved as this wellness trend should help address things like absenteeism and staff turnover.

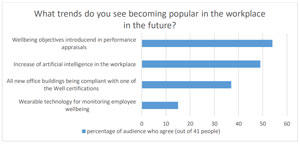

Clare closed the event by polling the audience again, asking them to vote on potential future trends. The results of which are in the chart below.

AREF would like to thank all the panellists for their very interesting insight, in particular our keynote Charlie Jacques and our excellent moderator, Clare Thomas. Thank you also to Vistra for sponsoring today’s event and to Schroders for generously hosting us in their new building. Lastly, thank you to all the delegates that came along from member firms today, making this event such a success. To keep informed of all the latest news from the real estate funds industry and for future events, please take a look at AREF’s website. Our events are free to all AREF members and to all professional investors in real estate funds and their advisors. You can also subscribe to our monthly newsletter and please follow, like and share us on Twitter and LinkedIn!

Sponsor

host